Warrants Guidebook

Risks

-

Market Risks

An adverse movement in any of a warrant's pricing variables - share price, time to expiry, volatility, interest rate and expected dividends - can have a negative impact on the warrant price.

When buying a warrant or any other investment product that is linked to the movements of a market, an investor is exposed to the risk that the share price, index futures or market as a whole moves adversely against them.

-

Gearing

Gearing the primary attraction of warrants, can be a double-edged sword.

A warrant will tend to appreciate and depreciate in percentage terms more rapidly than the underlying shares/index futures.

-

Limited Life

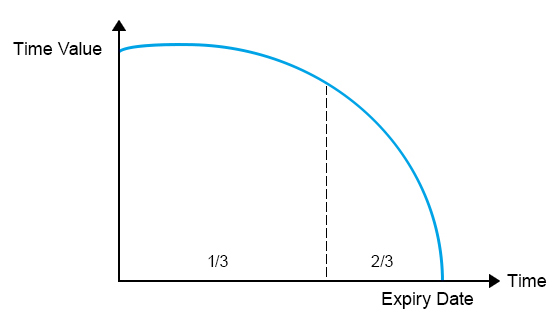

Unlike shares, warrants have an expiry date and therefore a limited life.

If the share price is below the exercise price for call warrants (or above the exercise price for put warrants upon expiry), the warrant will expire worthless. Investors must be aware that warrants are decaying assets.

-

Credit Risk

A holder of a structured warrant will be exposed to the credit risk of the issuer.

You can view Macquarie Group's most recent credit rating on our information page, click here.

-

Takeovers

Following a takeover announcement, there is a risk that warrant holders can lose their total time value. For example, say an investor bought a call warrant with a strike price of $10 when the shares were trading at $9, the warrant is out-of-the-money and therefore all of the price is represented by time value.

In the event of a takeover at $9.5, the warrant expiry would be brought forward to the current day and as the takeover price is below the strike price, the warrant would expire worthless.

In order for the warrant to have value in a takeover situation, the takeover price must be above the exercise price. Click here for more info on time value.