Warrants Guidebook

Why Trade Warrants?

Warrants have become increasingly popular because they give investors exposure to an underlying share/index for a fraction of the price. The movements in the warrant price are also usually much greater than the movement in the price of the underlying share/index. This means their potential to deliver a higher percentage return and higher risks is also increased.

Please click on each of the tiles below for more details

-

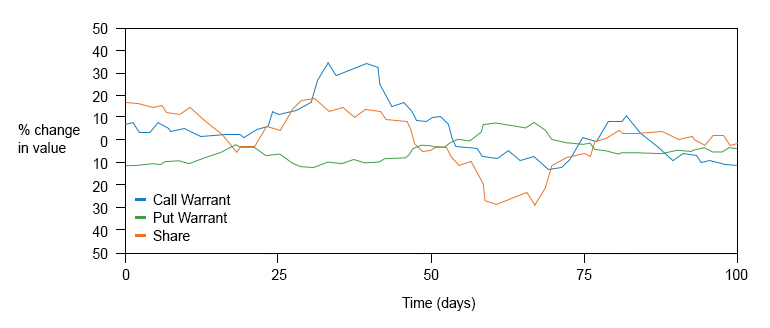

Gearing Effect

A warrant enables you to gain exposure to a security for just a fraction of its price, meaning you can get a similar effective exposure for a much smaller capital outlay. Therefore, warrants tend to move in greater percentages than the underlying shares, allowing you the potential for higher percentage returns and risks than if you had bought the shares directly. This is known as the gearing effect and the main reason warrants are so popular with investors.

Share vs Warrant Performance

-

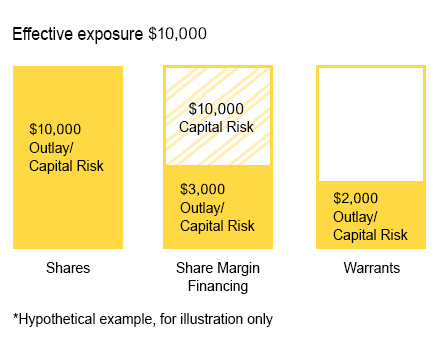

Limited loss

Gearing is one of the biggest benefits of warrants but gearing is a double-edged sword, as it also exposes investors to greater potential losses in percentage terms if their view is wrong. However, the difference between warrants and many other forms of leverage is that your risk is limited to the initial payment, meaning you can increase your exposure while limiting your capital at risk.

Look at our hypothetical example here. You can achieve an increased effective exposure of $10,000 by buying $2,000 worth of warrants, which limits your total capital at risk to $2,000. If you were to achieve the same exposure by buying the share directly or through share margin financing, you would be exposed to the full $10,000.

Effective Exposure Graph

-

Profit from bull or bear market

Warrants provide investors the opportunity to profit from both share price increases and falls. Call warrants can boost investors profit potential from share price rises while put warrants enable investors to benefit from sell-downs. Put warrants are particularly useful as they are one of the few instruments that allow retail investors to go 'short' (i.e. profit from downward moves) in shares.

Put warrants can also be used as a form of insurance to protect an existing share portfolio against a falling market (a process called “hedging”). An investor with a holding in a particular share, who is nervous about the future direction of the market, could purchase a put warrant. If the share price falls, the gains made on the put warrant can be used to offset the losses on their shares. This allows the investor to retain share ownership without having full exposure to the downside risks.

Index warrants are most typically used for hedging. Investors should, however, understand the complexity of utilising warrants for hedging or portfolio protection purposes. For example, the value of the warrant may not exactly correlate with value of the underlying shares.

-

No margin call

Even if the underlying share or index moves adversely, warrant investors will not need to make margin top-ups. The maximum exposure to the investor is set up front at the start of the trade. So you can rest a little easier.

-

Lower capital outlay

Warrants enable investors to gain exposure to blue chip shares for a fraction of the share price. An investor interested in purchasing shares who does not have immediate access to funds could purchase call warrants to capture the benefits of an anticipated price rise. Because of the significantly lower outlay for warrants, brokerage and transaction costs are also lower.

Shares Similar exposure through Warrants Cost $50,000 $10,000 Brokerage Cost* $125 $25 Stamp duty* $50 Nil *Assuming brokerage cost of 0.25% and stamp duty of 0.1% -

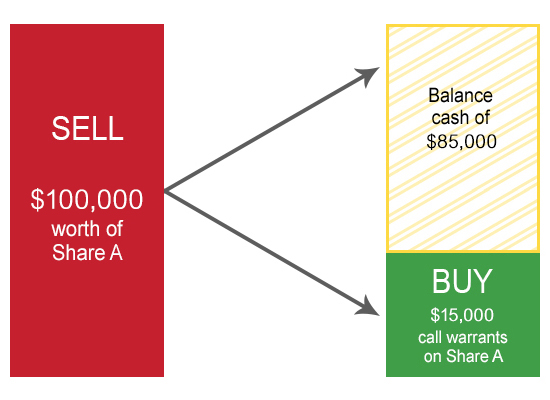

Releasing share capital

Using warrants to gain exposure to shares can free up the capital that would otherwise be invested into fully paid shares. Alternatively, an investor may sell existing share holdings and gain a similar effective exposure by purchasing call warrants for a fraction of the price. The investor has maintained exposure to share prices while releasing capital from the share holding.

-

Ease of trade

Warrants are traded on the Hong Kong Exchange allowing investors to buy and sell warrants just like shares. Due to the existence of designated market makers, warrants are typically very liquid meaning there should be sufficient volume on the bid and offer for investors to easily enter and exit their trade.