Warrants Guidebook

How to select a Warrant

-

View on Underlying Share/Index

When choosing a warrant, we suggest that investors consider the following 4 steps:

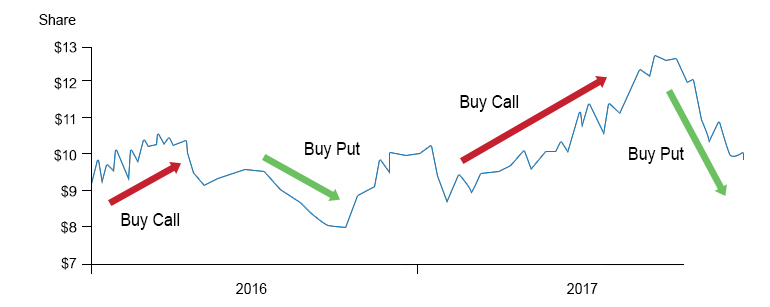

To choose a warrant you should first look at the nature and performance of the underlying share/index and take a view. Bullish investors may consider a call warrant while bearish investors may consider a put warrant.

In this first step, you also need to have a target price for the stock in mind. This will help you to narrow your selection of the warrants.

Are you bullish (call) or bearish (put)?

Warrant Call/Put Strike($) Expiry Date Warrant Price($) Effective Gearing(x) Implied Volatility(%) Warrant A Call 2.25 03-Jan 0.320 5.9 30 Warrant B Call 2.80 01-Feb 0.090 9.0 27 Warrant C Put 2.60 02-May 0.270 4.6 29 Warrant D Call 2.60 01-Jul 0.270 3.8 37 Warrant E Call 2.55 04-Jul 0.220 6.9 22 Warrant F Call 2.70 04-Jul 0.100 9.3 21 Market Maker

The quality and reputation of the market maker is also an important consideration when choosing which warrant investing in. You need to be confident that the market maker will be there to provide consistent pricing throughout the life of the warrant so that you can enter/exit the trade in a fair and liquid market.

Macquarie has a leading market share in the local warrant market and much of this success is due to the quality of our market making, something we are very proud of.

Risk Matrix

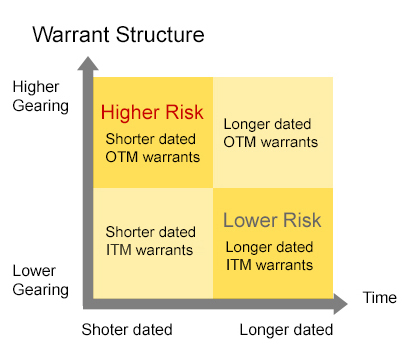

The chart below summarizes how the expiry date of a warrant and its gearing level affects the risk level of the warrant.

Generally, the shorter dated the warrants, the higher the risk of the warrant as there is less time remaining to reach your target price.

Warrants with higher gearing also carry higher risk as they require a larger movement in the underlying price for the warrant to have value remaining at expiry, indicated by OTM (out-of-the-money warrants) in the matrix.

Warrants with longer time to expiry and those that are deeper in-the-money (ITM) in the matrix are generally regarded as lower risk. Warrants that have further expiry dates allow more time for stocks to reach the target price and hence less time decay, while ITM warrants have lower gearing levels.

It should be remembered that the higher the risk typically translates to a higher potential return and vice versa.

Tips and Tools

warrants.com.hk has a selection of very useful tools that will assist in your warrant selection process and also in your subsequent decision on when to sell. Here are a brief summary of some of these:

Warrant search

Allows you to search for warrants by specifying your criteria, it will display all of the important info you need to make your decisions. Click here

Warrant terms

Lists all of the current pricing information for a particular warrant. Can be accessed directly or via clicking on a warrant code in the warrant search table. Click here

Compare warrants

Allows you to select two warrants and compare their details side by side. Click here

Moneyflows

Will allow you to see which underlyings other investors have been buying and selling warrants over, giving you a feel for the market 'flows'. Click here

Warrant calculator

Allows you to change the variables of a warrant and see the resultant effect on the warrant price. Click here

My Portfolio

Here you can build a watchlist or a portfolio to track the performance of your warrant positions. You can even set up alerts to warn you of certain market events, like price change, etc. Click here